- 5 Green Marketing Strategies - August 26, 2025

- Fintech Cocktails – Classic Cocktails With A Modern Fintech Twist - August 26, 2025

- Money2020: Should You Attend? - August 26, 2025

A fintech business’ brand identity is fundamental to its success.

It enables customers to easily identify your fintech and differentiate between fintechs and their competitors. This should ultimately translate into leads and sales.

A brand and its awareness in the industry is also part of the equation when valuing a fintech.

This article will run you through the crucial components that make up a fintech’s brand identity and how it can benefit your business.

So, let’s get started…

What is brand identity?

‘A brand identity is made up of what your brand says, what your values are, how you communicate your product, and what you want people to feel when they interact with your company. Essentially, your brand identity is the personality of your business and a promise to your customers.’

(HubSpot)

Brand identity is an aspect of your branding that focuses on your fintech’s personality, as well as the value you offer customers.

It contains intangible elements of your brand which relate to its meaning and the emotional connotations it carries. A strong brand identity also has practical value.

What is unique about fintech brand identity?

Brand identity should be the heart and soul of your fintech marketing. It is the first impression you make on your customers, and it helps build a long-lasting relationship with them.

Fintechs have transformed the payments landscape over the past decade, through the launch of challenger banks such as Monzo, Starling Bank, and Revolut.

These fintech brands are now household names. They have influenced the brand identities of countless other fintechs today.

However, their striking visual branding and colour palettes have proven far easier to imitate than authentically embodying the values that underpin them.

As a fintech marketing agency, we are often told by start-ups that they want a brand ‘like Monzo’.

What they fail to appreciate is that when they see the Monzo logo, they are not just reacting to its font, colours, or graphic elements, they are remembering how bold Monzo has been in their PR and the reaction they provoke in their fanbase.

It is that emotional connection they are looking to replicate. Just because you have a logo that looks a little like Monzo’s, there is no reflected glory of their achievements.

How can new fintechs stand out from the crowd?

Disruptors who are entering the fintech ecosystem can differentiate themselves through unique branding and positioning. This prevents them from getting lost in the already crowded sea of fintech providers and wannabes.

Just in case you are speed reading, there are two keywords here – branding and positioning. It’s not just your logo, it’s where and how you are positioned in the market.

Examples of great fintech brand identity

Open Banking businesses’ branding is a great representation of how fintechs’ brand identity is tailored to the industry.

In the UK, there has been a significant lack of trust in Open Banking services; with two-thirds of retail customers saying that they had no awareness of what Open Banking was and how it could benefit them.

This illustrates that Open Banking entities must place a great deal of focus on their brand identity, and ensure that they are consistent with their branding to win consumers’ trust.

Yapily is an example of this done well. Labelled ‘Best Open Banking Solution’ at the PayTech Awards, Yapily has consistent and recognisable branding across the entirety of its website and social media channels.

This has helped them build a reliable and trustworthy reputation, as well as build a community amongst their user base.

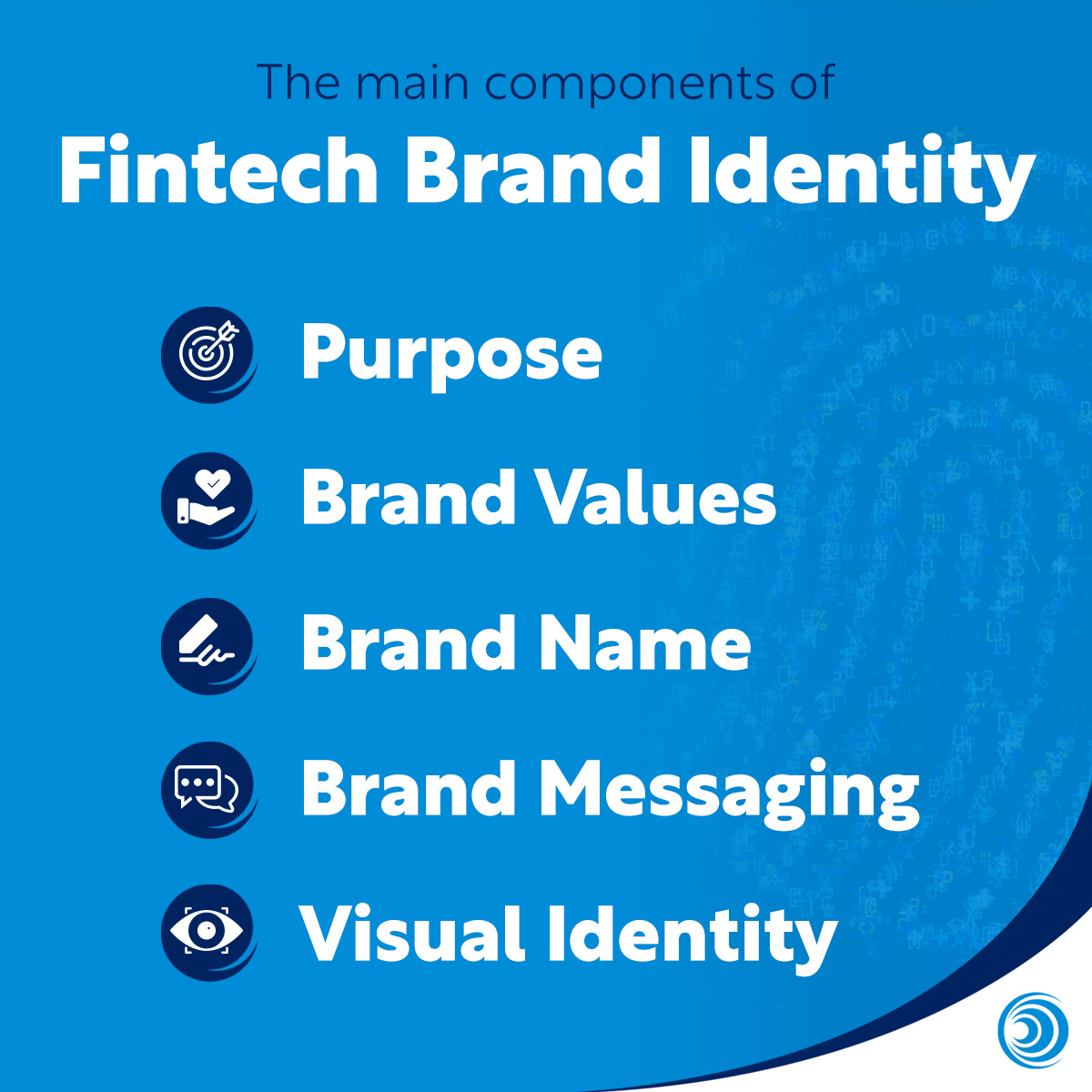

The main components of a fintech’s brand identity

Brand identity includes the brand’s visual elements, such as tone of voice, graphical elements, and colours, that identify and distinguish your brand in your customers’ minds.

These visual elements need to be cohesive with all other components of your brand identity, just as your purpose must align with your brand values.

Brand identity is the result of the following:

Purpose

A brand’s purpose is its reason for existing – something bigger than simply generating profits from its products and/or services. ‘Wanting to become a unicorn (a stand-out business with high growth)’ is also not considered to be a sufficient altruistic purpose.

When developing your business’ purpose, think about:

- Who your brand is and why you are a business?

- Your long-term goals

- Do your customers share the same views?

Your fintech’s brand purpose should add value to your customers as well as build a more emotional relationship between the business and the customer. This in turn will help boost sales and brand loyalty.

An honest and moving brand purpose will show how your business is genuine and set you aside from your competitors.

In many ways, it was easier for the early fintech challengers to articulate their purpose. It was usually something along the lines of ‘do better than mean, dishonest legacy banks’.

While the legacy banks have still not been toppled, fintechs are moving away from generic anti-legacy bank messaging. Instead, consumers are looking for something more altruistic.

Consumers are becoming more inclined to see a brand’s purpose as an important factor when deciding whether to purchase something – 86% of customers expect brands to take one or more actions beyond their product and business.

So, ensure that your brand purpose connects with your customers on a personal level.

Brand values

A company’s brand values are a set of guiding principles that shape every aspect of the business.

Ironically, establishing brand values and embedding them into fintechs often gets less focus and time than choosing a logo.

Arguably it’s living your brand’s value and not the design of your logo that is really at the heart of brand building.

Brand values often cover topics about:

- Leadership

- Collaboration

- Passion

- Diversity

- Work ethic

- Sustainability

Your brand values should express your attributes and characteristics to your customers, as well as potential employees.

Strong brand values help to give you a competitive edge, as well as boost your sales and awareness.

Brand name

A bold and memorable brand name will be important to the success of your business.

Not only does it help customers easily recognise your business, but it also distinguishes you from your competitors and should leave a lasting impression on them.

Many fintech names do not directly reflect the service they provide. They are abstract constructs that are designed to be memorable rather than descriptive.

The trend of dropping vowels from fintech names was very popular several years ago. There has been a backlash against this. The Standard Life Aberdeen received a public roasting back in 2021 after they rebranded to Abrdn.

Interestingly, Railsbank has recently done something similar. Now called Railsr, they have dropped the ‘bank’ element of their name. They have stated the objective of the change is to move ‘beyond fintech’ and focus on their embedded finance proposition.

Brand Messaging

Brand messaging is the way your brand communicates its value proposition and personality to your customers and potential customers.

Your messaging can help build a connection with your potential customers.

When you begin to craft your brand messaging, keep your target audience and USPs (unique selling proposition) in mind.

Your messaging should determine your brand tone of voice. This will be reflected in your website copy, content, and social media communications.

Is your brand about disruption or reassurance? Is it about provoking action about social injustice or empathy for a charitable cause?

You should tailor your approach depending on your fintech’s USPs and target market.

Legacy banks, like NatWest and HSBC, take a relatively formal and traditional approach to their messaging. Whereas it is common for fintech unicorns to be more playful and informal.

A fantastic example of this was from Twig, a card that instantly sends money to users in exchange for them sending their unwanted goods.

Their messaging on social media is very fun and playful, making jokes and using memes. This is also demonstrated through their ‘gaming’ themed website. This is a common marketing tactic when a company is trying to target a younger demographic.

Another important thing to consider when curating your messaging is whether you have a B2B or consumer offering.

Like legacy banks, a B2B fintech may take a more serious, formal stance when wanting to communicate with businesses and potential investors as they want to build trust and authority.

Lloyds Bank, founded in 1765, is an example of a traditional, legacy bank that takes this approach. Their social media messaging is very formal, factual, and full of statistics.

Visual identity

Did you know it takes people an average of 7 seconds to form an impression of your brand?

That’s why it’s important to get your visuals spot-on.

Visual identity consists of a brand’s logo, brand colours, imagery, and typography. Selecting a cohesive set of brand assets will help consolidate your brand guidelines, giving your brand an aesthetic identity.

Applying strict brand guidelines throughout all visual elements of your brand will help build brand recognition across your customer base and your industry.

When thinking of visual branding done well, Lemonade Finance springs to mind. Their green, purple, and pink colour palette pops and is recognisable across their website and social media channels.

Their logo also ties in with their brand name as it is in the shape of a lemon and uses a retro-style font.

A brief history of brand identity

Brand identity is ever-changing and fast-paced, just like the fintech industry itself.

So, let’s take a quick history lesson on the history of branding…

Early brand identity

Branding began way back in the 1500s when it was common to brand cattle to show ownership.

During the industrial revolution, there was an increase in the number of physical products manufactured, meaning more choices for consumers.

As early as the 1870s, trademarks began to be adopted. As a result, brand identity became intellectual property for the first time.

The 20th century saw the emergence of many iconic brands, such as Coca-Cola, Chanel, and Lego.

They were ahead of the time, making their mark through branded advertisements in newspapers and magazines. Print media allowed them to showcase their visual identity.

Post World War 2, brand identity was more important than ever. There were so many more pathways for brand creation and recognition such as radio, billboards, packaging, and television commercials.

This was the era in which we saw a true shift in marketing.

But what’s branding like today?

Brand identity today

In the digital age, brands have more opportunities to showcase their identity than ever. While print media is still a valid channel, technology and the internet have spawned many new opportunities, including organic and paid social media.

Social media has enabled brands to showcase their unique messaging and their visual identity to a new generation of customers with tactics including branded hashtags and bespoke infographics.

Keeping up-to-date with new trends in fintech marketing is important. Some of these are unique whilst others show clear influence from other industries.

To stand out from the crowd, many brands (especially fintechs) use mission and purpose-based branding.

Popular fintech, Currensea, has a mission to encourage consumers to enjoy travel while supporting the environment.

It enables users to contribute a percentage of their savings to an environmental organisation every time they spend. Customers can save to plant trees or remove plastic bottles from the ocean.

With developments in Web3 and the metaverse, we’re excited to see what new opportunities will arise to develop fintech branding with emerging technologies.

The benefits of a good fintech brand identity

When branding is done well, there are many important benefits:

Develops trust and loyalty

Branding provides the opportunity to build trust with your B2B buyers or consumers.

Repeated positive engagement can help a company build trust. Consistently producing engaging and valuable content for your customers can help you create positive associations with your brand.

Build communities

Once brands build trust with their customers, they can develop long-lasting relationships. These loyal consumers play a vital role in building a community around your brand.

Members of a brand’s community will continuously interact with other members, gaining value and satisfaction from consuming products and/or services with like-minded individuals.

By sharing information with your community, your brand can derive real value from customers by encouraging engagement and gaining feedback. This will enable you to develop a closer relationship with your brand community and help ensure its long-term success.

Makes your advertising more effective

Brand identity and recognition are critical at all steps of developing your advertising.

Consistent colour schemes, imagery, and tone of voice will help make your business more recognisable and encourage instantaneous recognition from potential customers.

As your company’s brand recognition builds, your marketing and paid advertising should become more effective, assuming your ads are targeted effectively.

Distinguishes you from your competition

A strong brand identity will differentiate your business from your competition.

Just think about when you last walked around Money20/20 or any other fintech event, for example. You will have walked into the venue and quickly scanned the stands to see if there are any brands you immediately recognise and want to visit. You need a visual brand to be distinctive from the other side of the exhibition hall.

How to develop your fintech brand identity

Sometimes branding might need to change, other times it can change without your permission.

Sometimes the biggest threat to your brand can come from within.

Be ruthless with your internal team who might start to ‘personalise’ their PowerPoint presentations or Word documents with their favourite font or colours. This will undermine your brand so nip it in the bud.

Always keep your brand guidelines accessible to all team members. Similarly, make sure everyone has access to a shared drive where they can always find the most up-to-date versions of your PowerPoint and Word templates.

That way, there can be no excuses for not knowing the standards or which versions they should be using.

Rebranding should only be done when you need to send a big and bold message out to your market. Either you are fundamentally changing your positioning or proposition or moving away from your current marketing phase and into a new one.

A brand refresh, on the other hand, can be a good idea to carry out every few years. It involves updating any tired aspects of a brand whilst continuing to be recognisable to your loyal customers.

Conclusion

Brand identity isn’t just a logo – it consists of your brand purpose, values, name, messaging, as well as your visual identity. It’s what makes you, you.

Brand identity in the fintech industry is unique. Whether you’re an Open Banking solution or a fintech disruptor, your approach to your branding will be different.

When branding is done well, it allows your business to be differentiated from your competitors and gain trust and loyalty amongst your customers. It also has very practical applications such as events, where you need to stand out from the crowd.

Once you’ve tailored your branding to your business, it doesn’t just stop there. You must protect your brand from erosion by internal team members evolve it with care and ensure it serves a specific strategic objective.

At Blue Train Marketing, we specialise in fintech. Whether you’re a start-up or an established enterprise, we can help take your branding and messaging to the next level. If that sounds like something you’d be interested in, get in touch.